Updating Your Billing Information

Only the account owner can modify company billing details in tomHRM.

Steps to Update Details

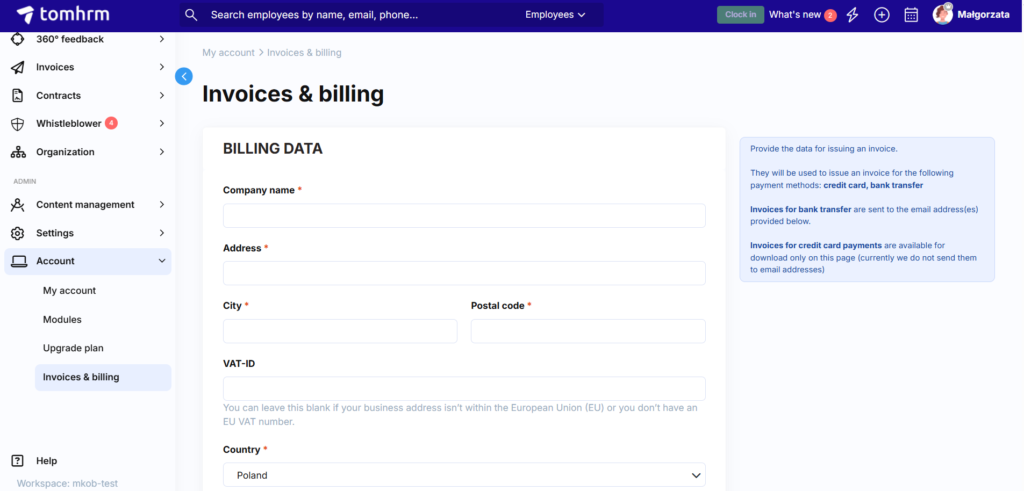

- Navigate to Account > Invoices and billing

- In the “Billing Details” section, enter your new information

- Save changes

What happens next: Your updated details will appear on all future invoices, whether sent by email (bank transfer payments) or downloaded from the system (credit card payments).

Important: You cannot change details on invoices that have already been issued.

Correcting Already Issued Invoices

Minor Corrections (Correction Note)

When to use: If part of the buyer information or service details are incorrect, such as:

- Incorrect buyer details (address, VAT number, company name)

- Wrong issue/sale/payment date

- Incorrect product/service description

- Wrong invoice number or payment method

For Polish-registered companies: According to Polish tax law, your company must issue a correction note.

How to submit:

- Use our support form at support@tomhrm.com, or

- Send in paper form to our company address

tomHRM will confirm receipt of the correction note using the same method you used to send it.

Major Corrections (Invoice Correction)

When to use: If the invoice was issued to completely wrong details (different company), tomHRM will issue a corrective invoice followed by a new, correct VAT invoice.

When to use: If there are errors in invoice items specified in Article 106e, Section 1, Points 8-15 of the Polish VAT Act:

- Unit price or total net sales value

- Tax rate or amount

- Total amount due including tax

In this case, tomHRM will issue a corrective invoice.

How to Request Invoice Corrections

For both correction scenarios, contact us using our support form with:

- Your invoice number

- Details of the error

- Correct information that should appear